Financial Inclusion

Financial inclusion is an important feature of a financial system that supports economic participation and prosperity. Financial Inclusion is one of five priorities for the Council of Financial Regulators (CoFR).

What is financial inclusion?

We have adopted the World Bank definition of financial inclusion for the purposes of our shared work as CoFR: “when individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way”. The ability for New Zealand firms and consumers to access appropriate financial products and services is an important enabler of a modern, efficient and inclusive financial system.

For example, having access to affordable capital can unlock the potential of small businesses to grow and thrive1, and having access to a bank account enables people to safely receive, store, spend and save money.2 We also note that financial products and services, when not well suited to someone’s needs, can harm financial health and wellbeing (for example, promoting access to credit at any cost, irrespective of the financial situation of consumers).3 Our vision for financial inclusion is:To improve consumers’ and firms access to financial products and services that meet their needs.

CoFR agency roles and responsibilities relating to financial inclusion

A community of staff from across CoFR members and relevant partner agencies (such as the Ministry of Social Development and Te Ara Ahunga Ora) meet regularly to:

- connect between our agencies to clarify our roles, responsibilities and work programmes relating to financial inclusion.

- learn from the experiences of community organisations, academics, and private sector leaders to identify emerging financial inclusion opportunities.

- identify gaps in the system and strategic priorities where we can deliver positive, tangible improvements to promote an inclusive financial system.

The diagram below outlines the various roles and responsibilities of each agency.

Figure One: Council of Financial Regulators Financial Inclusion diagram.

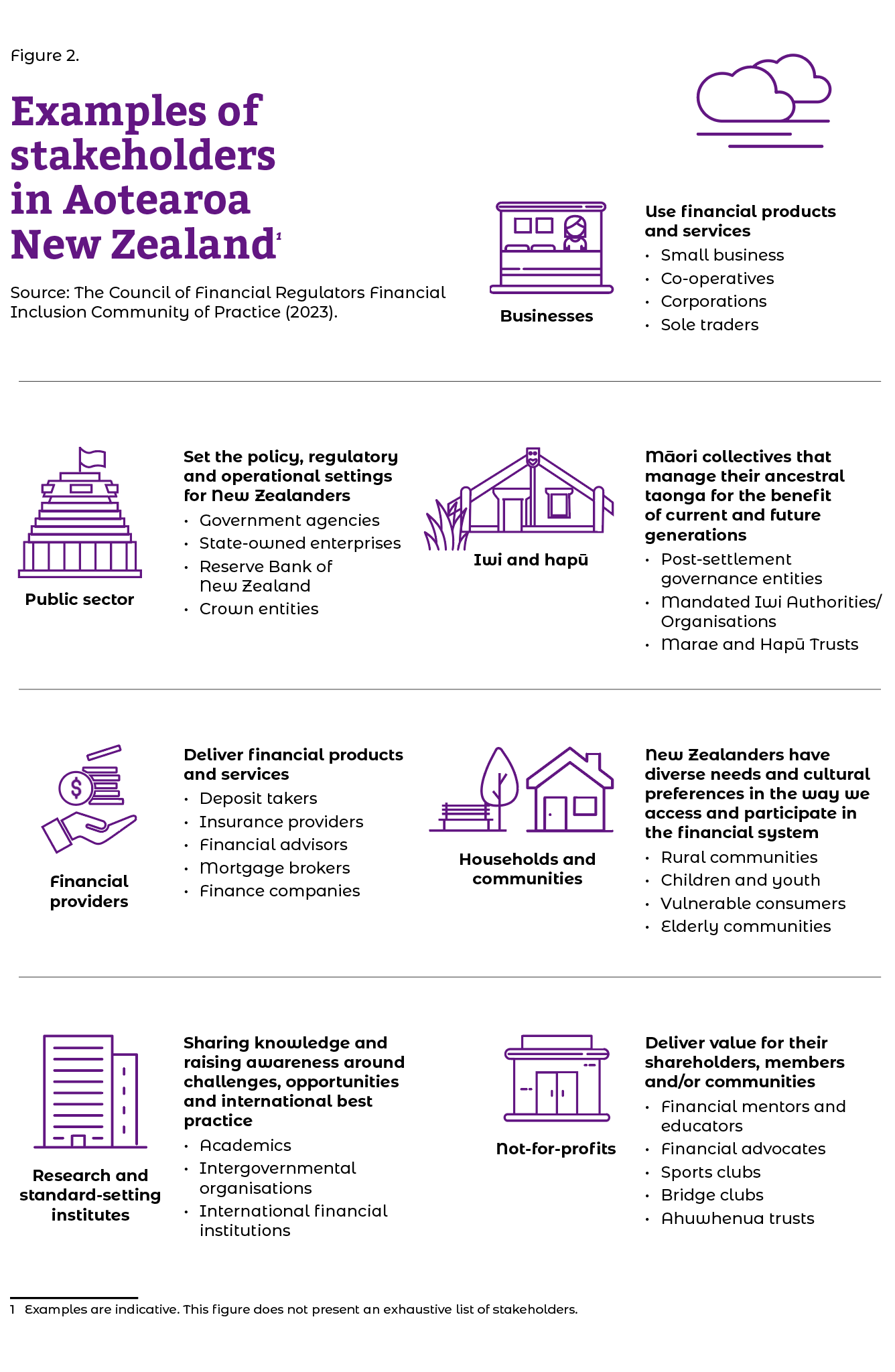

The priority for the CoFR Financial Inclusion Community of Practice in 2023 was to learn from the experiences of academics, industry leaders, and community organisations to identify key financial inclusion opportunities and challenges. The diagram below outlines key stakeholders in Aotearoa New Zealand, noting that examples are indicative only and not intended as an exhaustive list.

Figure Two: key stakeholders that contribute to financial inclusion.

Our engagement in 2023 helped our Community of Practice to identify two priorities that we intend to explore over the coming year: access to basic bank accounts and Māori access to capital.

Access to basic bank accounts

Having an account at a financial institution (bank account) is a foundational entry point into the financial system. Having a bank account enables economic participation and a means to receive, store, save and spend money.

According to World Bank data, there has been an increase in the unbanked population in New Zealand since 2014.4 This decline is particularly pronounced for youth and those not in the labour market. Figure Three below uses World Bank data that estimates the number of people (aged 15+) who did not have a bank account in New Zealand between 2011 and 2021.5

Figure Three: Estimated population (age 15+) without an account at a financial institution in Aotearoa New Zealand. Source: World Bank Findex Database6 and Statistics and New Zealand National Population Estimates.7

The issue of access to bank accounts has been salient in our engagements with stakeholders so far, with mounting research on the impacts that not having access to bank account has on people’s lives, wellbeing and integration in society.8 Access to bank accounts issues were also highlighted in the Commerce Commission’s personal banking services market study draft report.9

We have looked at overseas case studies to consider how other jurisdictions have approached this issue. We note the experiences of Sweden, Denmark, France, Ireland, Australia, Canada and the UK, where a universal right to a basic bank account has been legislated by Government or codified in binding industry code. We intend to continue to explore this topic further in 2024 in partnership with public sector and private sector stakeholders.

Māori access to capital

Access to affordable capital enables businesses to invest and therefore expand, diversify, hedge risk, and thrive. Māori businesses are constrained by the barriers they face accessing capital, and the difficulties they face leveraging existing assets.10

Several gaps exist in the data around Māori access to capital, Māori businesses, and the Māori economy more broadly to inform evidence-based decisions that support strong outcomes. A lack of capability to work with and understand Māori business models and values, and whenua Māori lending arrangements may be informing misconceptions around the risks involved with lending against whenua Māori, a mismatch of products and services, interest rate premiums, and low responsiveness to Māori business needs.

We intend to continue to work with regulated entities to improve Māori access to capital and build more robust data. We have expectations that the banking industry is supporting Māori access to capital through:

- capability building (understanding Māori business value propositions and whenua Māori lending arrangements);

- ensuring the treatment of risk reflects actual risk; and

- collecting more robust data.

We anticipate that focusing on these foundational steps will contribute to industry development of innovative products and services that better meet the needs of Māori businesses.

We look forward to further engagement with our key stakeholders in 2024 on these topics, acknowledging that important work is already underway in many cases.

News and reports

- COVID-19 exposing New Zealanders’ financial vulnerability

- Commerce Commission - Market study into personal banking services (comcom.govt.nz)

- MyMahi - New Zealand Parliament (www.parliament.nz)

- FinCap-Paying-the-Price-Final-25-June.pdf

- Westpac-NZ-Access-to-Banking-in-Aotearoa-Report.pdf

Useful links

- CoFR vulnerability framework (PDF 143KB)

- The National Strategy for Financial Capability

- The Safer Credit and Financial Inclusion (SCAFI) Strategy (MSD)

- Review of consumer credit law (MBIE)

- Supporting customers in financial difficulty (FMA and Commerce Commission)

- RBNZ’s Approach to Financial Inclusion (RBNZ)